TICKET' S DI TOSCANO DANIELA MARIA PATRIZIA - 95, Via Giacomo Leopardi - 95037 San Giovanni La Punta (CT)

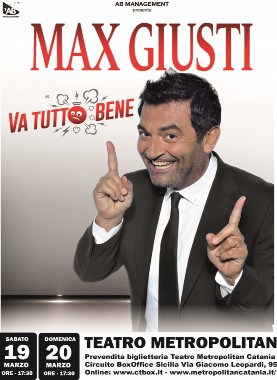

BOX OFFICE SICILIA - BIGLIETTI PER CONCERTI E SPETTACOLI VENDITA E PRENOTAZIONE - VIA GIACOMO LEOPARDI, 95, 95127 CATANIA (CT)

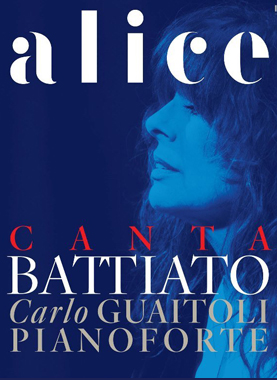

Ibla Classica International - REGIONE SICILIANA, ASSESSORATO REGIONALE DEL TURISMO, DELLO SPORT E DELLO SPETTACOLO, COMUNE DI CATANIA, ASSESSORATO ALLA CULTURA DEL COMUNE DI CATANIA, CATANIA SUMMER FEST, TAOARTE, TEATRO MASSIMO BELLINI

Ibla Classica International - REGIONE SICILIANA, ASSESSORATO REGIONALE DEL TURISMO, DELLO SPORT E DELLO SPETTACOLO, COMUNE DI CATANIA, ASSESSORATO ALLA CULTURA DEL COMUNE DI CATANIA, CATANIA SUMMER FEST, TAOARTE, TEATRO MASSIMO BELLINI